Interest rate is of interest

Here are some companies whose valuations have hugely plummeted in the year 2023.

Notion -28%, Plaid -79%, Brex -53%, Airtable -30%, Chime -44%, Epic Games -42%, Discord -35%, Flexport -31%, BYJU’s -28%. Source

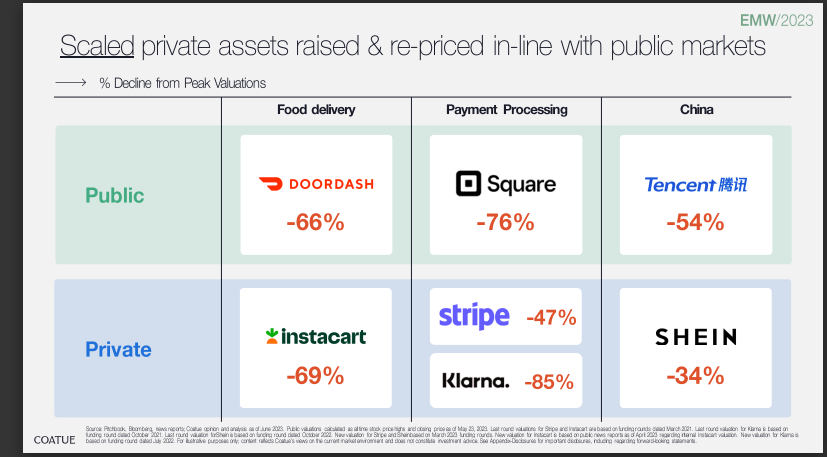

Here are some more companies with massive declines from their peak.

The number of new unicorns worldwide is way down.

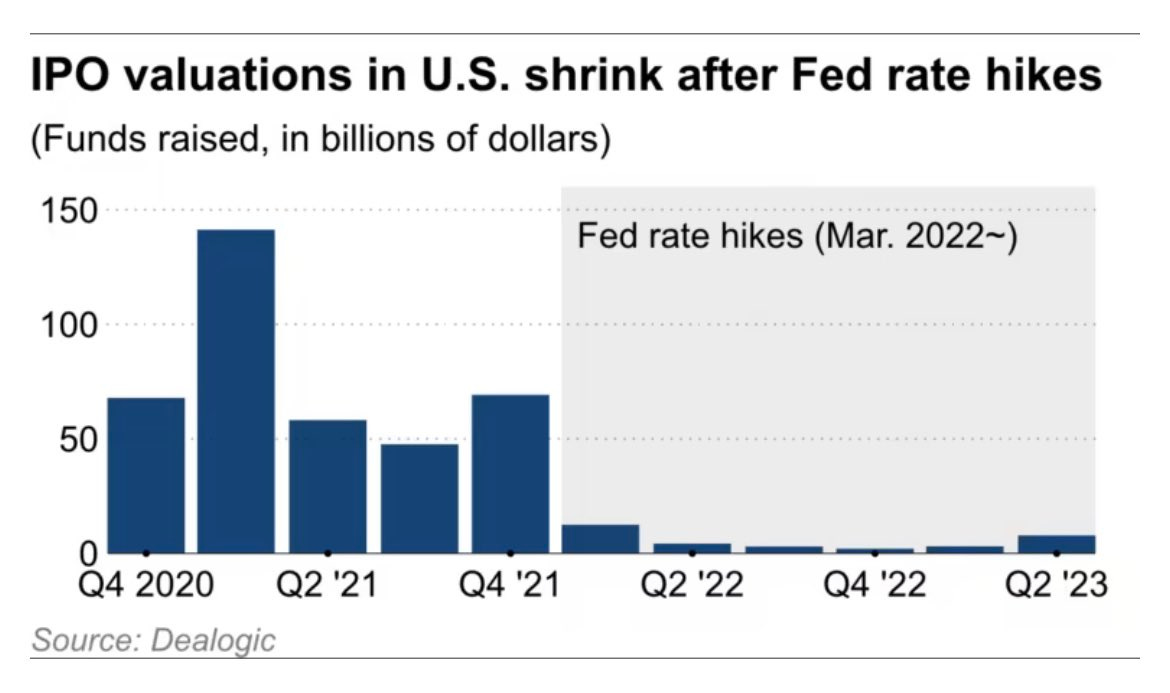

Blockbuster IPOs have disappeared.

WeWork, currently valued at $47B, might not survive. Clutter, valued at $600M in 2019, is being sold cheaply. Bird raised $700M, went public, and now faces bankruptcy. As per FastCompany, Venture-backed startups are failing at record rates.

Layoffs are happening daily.

Why is this happening? What changed?

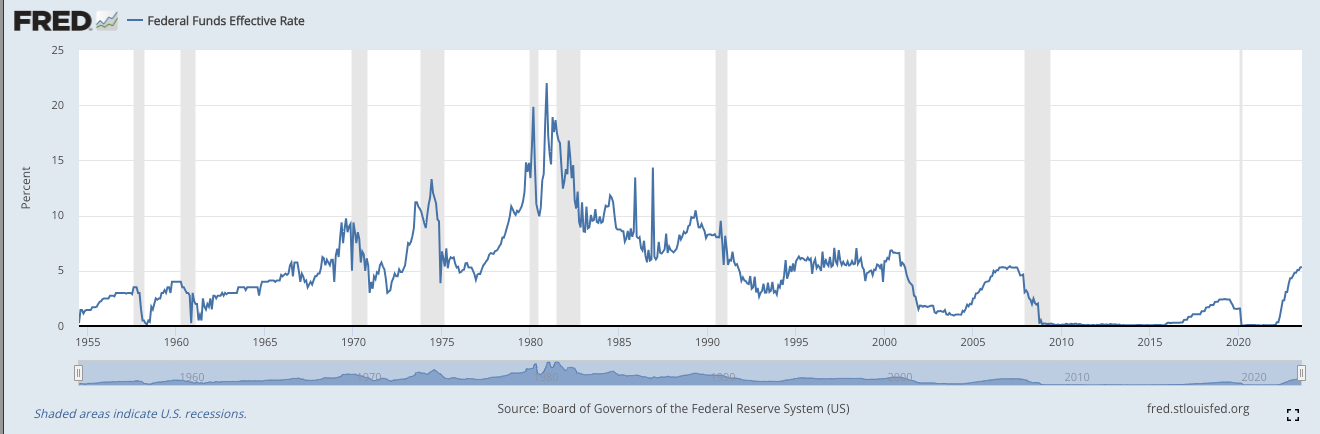

Well, the previous graph provides a hint. It says, “Fed rate hikes.” In this article, we’ll see how money got cheaper during the pandemic and how it impacted businesses. What caused inflation? What did the Fed do to tame inflation, and how did that cause a meltdown in the tech world? This touches upon the basics of money supply.

The US economy, or any economy, is very complicated, and it’s hard to present a simplistic view. However, without a simplistic view, only the folks holding a Ph.D. in economics could understand all the jargon related to monetary policy. Please note that things have been overly simplified so that we can discuss the high-level points.

When not writing blogs like this, we are working on neeto. Please check it out and let us know what you think of it. neeto is on Twitter. You can also subscribe to this newsletter.

ACT 1 - Low-Interest Rate Era

In March 2020, we had a pandemic. Because of the pandemic, many businesses shut down. The government started worrying. If businesses shut down, then it will cause unemployment to rise, and the economy will falter.

Because of the pandemic, physical contact was impossible. However, if businesses have an online presence, they can stay in business. The issue was that most of the small to medium-sized businesses had only a very basic online presence, and they didn’t have enough money in the bank to pay for the digitization of their business.

One solution to this problem was giving these businesses loans at a very low interest rate. That’s what the government did. It printed a lot of money, gave billions of dollars to various banks, and asked these banks to loan out the money to businesses. These banks got these loans from the government at zero interest rates. So if these banks give out loans at, say, even 1%, they will make money. The banks can’t charge a very high-interest rate because other banks also have billions of dollars, and the market competition will ensure that the interest rate on the loan is not very high.

In other words, the government reduced the interest rate to zero.

The interest rate on the loan is of critical importance here. That’s because if the interest rate is very high, businesses would not take loans to digitize their business, and the government’s whole program of keeping the economy running would fail. That’s why the government printed a lot of money and gave lots to the banks for low-interest rates.

The government’s strategy worked. Businesses took loans at a very low-interest rate. Now businesses have the money. The next step is to build their IT team by directly hiring or hiring consulting companies like BigBinary (full disclosure: we are the authors of this article) to build the website, mobile apps, analytics and whatnot.

More and more businesses are digitizing themselves. People are always home, so they watch more Netflix and use more Facebook and Instagram. All this means that businesses would end up using more AWS, Azure, GCP etc. So the Wall Street folks bought stocks of the big tech companies, which drove the stock prices of the tech companies really high.

These Wall Street folks saw what was happening in the economy. Because of the pandemic, everything needed to be digital. It means more software. This, in turn, requires more online payment processing, more API management tools, more remote monitoring software, more online video calls, more documents, more collaboration tools, more engagement tools, more monitoring tools, more chat tools and more project management tools. In short more software in the world, and that means more opportunities for tech startups. Some of these startups would eventually make it big. So, Wall Street folks gave more money to VCs. So now VCs have lots of money.

We have a situation where regular businesses are looking for IT folks to build software. At the same time, VCs have a lot of money and want to put that money to use. However, the speed at which VCs can get money is much higher than the speed at which startups can be produced. It takes time for a startup to set its roots and to be established. So now we have a somewhat upside-down demand and supply situation where we have too many VCs with too much money and not enough startups to deploy cash.

VCs have another problem on their hand. If they have taken billions of dollars, they can’t possibly spend that on hundreds of start-ups giving $1M each. Funding a startup is a lot of work. Before VCs fund a startup, they need to do their due diligence. After the funding, most VCs take one or more board seats. If these VCs fund hundreds of startups, taking small amounts of money, then that would be so much work for them. It’s much easier to fund one company that needs lots of money. It means that the VCs need to find startups that need 100s of millions of dollars. Possibly billions of dollars. There are not many startups that can take that much money.

In this environment, if a startup says that it needs 100M funding, then all the VCs fight among themselves to fund the company. Because of this, the startups could negotiate an excellent term sheet, which helped push their valuations into the stratosphere. This is how a lot of unicorns were minted.

Now, we have a situation where startups have lots of money. Well, what do they do with that money? They will do sales and marketing, but a large chunk of that money will go to hiring engineers. Guess what? The number of engineers available in the market has not gone up much. These VC-funded companies have lots of money sitting in the bank. So they offered lavish salaries to the engineers to hire them. This helped push the salary of the engineers to a very high level. The shortage of software engineers was so acute that BharatPe, a startup from India, started doling out BMW bikes as an enticement to join the company.

Note that the interest rate is low in general. Businesses can take loans, as well as the general public can also take loans at a very low-interest rate. If you are buying a house and need to take a loan for 15 years, this is an excellent time to take that loan. And that’s what lots of people did. They took loans to buy 2nd and 3rd houses and then put those houses for rent. One side effect of this low-interest rate environment was that it increased the real estate price since more and more people want to take loans and own real estate. The supply of real estate didn’t increase, but the demand did, pushing the price higher.

And then the pandemic was over.

Now people can travel. And travel they did. They had been couped up in their houses for more than two years. Demand for air travel doubled, but the supply was the same. So ticket prices went up. Same with hotels. Folks traveling need to stay in hotels. The hotels’ supply had not increased, so the hotel price increased. Demand for Airbnb houses went up.

You can see the trend. The price of almost everything went up. And that’s what inflation is. Global supply chain issues and the war also hugely contributed to inflation.

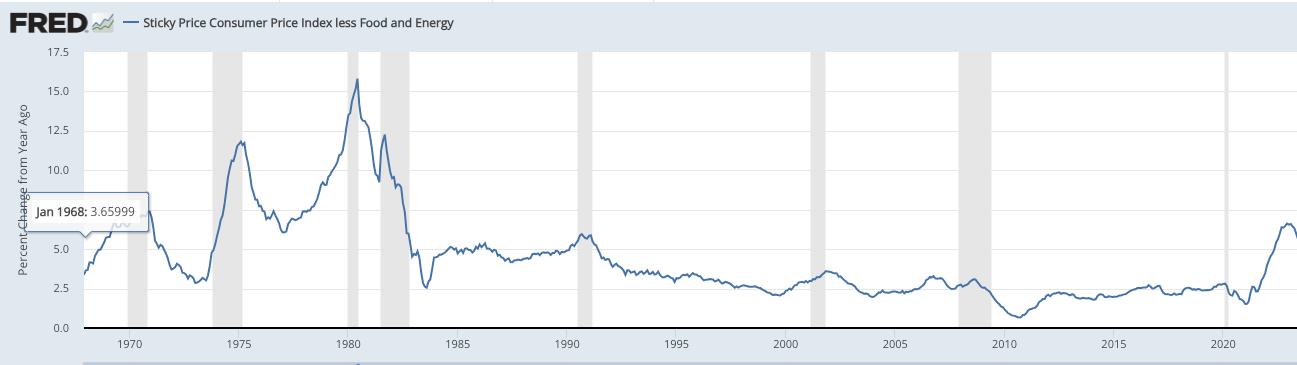

As you can see from the graph, inflation is up, making the government very nervous. They need to do something to bring the price down.

We already know what caused the inflation in the first place - cheap money in the form of low-interest rates. So the solution is easy. Make money more expensive to borrow.

And that’s what the government did. It slowly increased the interest rate. In 18 months interest rate slowly went from zero to 5.5%. So now the question is, what’s the link between tech layoffs and the interest rate?

ACT 2 - Interest rate going up

VCs invest money in tech companies because if a startup goes big, it has the potential to bring lots of profit. Tech businesses have high upfront costs. Once the software is built, then the marginal cost is meager. Because of the nature of the software, VCs need to put in a lot of money upfront and hope that after 5 to 10 years, they can get a handsome return on their investment.

Before we proceed further, we need to discuss the value of money today compared to the value of money tomorrow.

Let’s say that I give you two choices: Will you take $10,000 today or $10,000 a year from now? It’s an easy call. You will take $10,000 today.

How about $10,000 today or $10,900 a year from now? Now you will think. You will think because you need to know what the interest rate is in the market. For the sake of simplicity, we will ignore that you can invest the money in stocks etc. If the bank gives an interest rate of 5%, $10,000 would be worth $10,500 a year from now. But I’m offering $10,900 a year from now. So $10,900 a year from now seems like a better deal.

For this analysis, we looked at what $10,000 would be tomorrow. We can also look at what $10,900 would be worth today. The bank is providing interest rate of 5% so we need to divide the number by 1.05. 10,900/1.05 = $10,380.00. Clearly, $10,380 is more than $10,000, so you should wait one year to take more money.

What if the interest rate is 10%? In that case, what is the present value of tomorrow’s money?

10,900/1.1 = $9909. If the interest rate is 10%, I’m better off taking the $10,000 today itself.

It means that when the interest rate is higher, getting “delayed money” is not good because I can use the “current money” to make more money because of the high-interest rate.

Now, let’s get back to the VC discussion.

A VC is contemplating investing in a new AI software that makes videos. VC is thinking of putting in $10M. Let’s say that the VC expects a return of 5x in 5 years. So, the VC expects to get $50M in 5 years.

Let’s see what that $50M looks like in the present value. If the interest rate is zero, the present value of “$50 M in five years” is $50M.

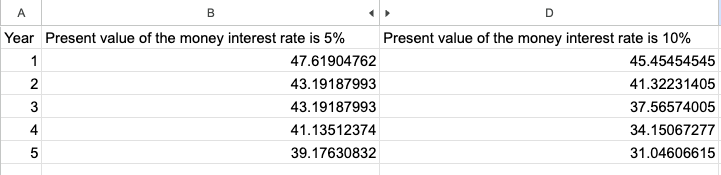

Let’s see the present value of $50M when the interest rate is 5% vs when the interest rate is 10%. The following graph shows the current value of $50M in x years when the interest rate is 5% and when the interest rate is 10%.

As we can see, the higher the interest rate, the less the present value of tomorrow’s money. If the interest rate is 10%, then $50M in five years from now is the same as the $31M today. It means the payout for the VCs is less valuable if the interest rate is high.

Instead of investing in startups, the VC can put money in the bank(government bond). If the interest rate is zero, then the VC is not getting any interest on that money. However, if the interest rate is 5%, VCs can earn money on their investment in the bank(government bond).

So, for VCs, a higher interest rate presents challenges from both ways. The value of future money is less, and secondly, if VC puts money in the bank(government bonds) instead of investing, VC would be making some money in a pretty safe way.

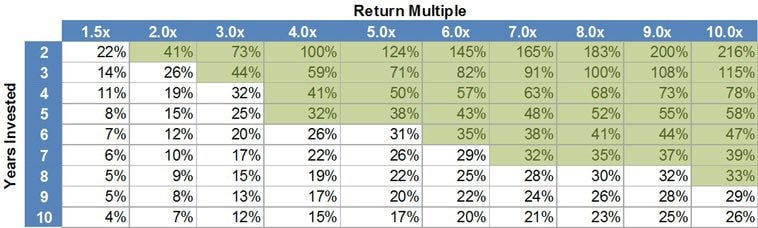

VCs calculate how well they are doing by tracking IRR(Internal rate of return). As per the below data, if a VC makes 3x in 10 years, that’s an IRR of a mere 12%. I say a mere 12% because these VCs are taking huge risks by investing in startups. Most of the startups go bust. If, after putting money in for ten years, they get a 12% return, they might as well put that money in an index fund and get a 8% to 10% return with a lot less risk.

This is why VCs are investing less and less money in startups in the high-interest rate era. If a startup runs out of funds, it will likely have a more challenging time raising more money in the current environment. That’s why the startups are trying to cut costs and be profitable to self-sustain without more VC money. Hence, layoffs in the tech sector to cut costs and make the existing money go longer.

Growth at all costs is not the playbook now. Survival at all costs is.

The same playbook applies to crypto. VCs poured much money into crypto when the interest rate was zero. With the higher interest rate, crypto needs to bring more return than the interest rate. That didn’t happen, and the VCs stopped pumping money into crypto. Plus, the regulatory environment in the USA changed. After the collapse of FTX, regulatory agencies are taking a more rigid stand on crypto.

ACT 3 - Reserve ratio and money supply

Let’s say that you started a bank. The name of the bank is BankA. Depositors trust BankA, and they deposited $100M. BankA will give some interest to the depositors. Now BankA needs to invest this $100M somewhere to make money.

To start a new bank BankA needed to get approval from the government. And the government says that you can’t invest all the depositor’s money. You always need to have a minimum percentage of money in your vault in case depositors come and demand the money. That’s called the “reserve ratio.” Currently, the reserve ratio is 10% in USA. It means that BankA must always keep 10% of the deposited money in the vault. It means on a deposit of $100M BankA can give $90M in loans to others. And that’s what BankA did.

BankA gave loans to businesses and people. For the sake of simplicity, let’s assume that all the $90M was given to a single business. Now, what did that business do with this money? They spent some money on buying land, spent some money on setting up plants, hired a bunch of contractors etc. In short, they spent part of $90M and kept the remaining in a bank account. What do you think the people who got all this money did with the money? They deposited all this money into their bank accounts. It doesn’t matter if you are an employee, a vendor, or a contractor. If you got money, then you are most likely to deposit that money in your bank account.

It means all the $90M came back to different banks. For the sake of simplicity, let’s assume that all $90M came to BankB. Now, the same reserve ratio rule applies to BankB, too. BankB must keep 10% of the deposited money, and they can loan out the remaining amount. It means BankB needs to keep $9M in the vault, and it can loan out $81M.

That $81M loan will follow the same cycle. That money will go out to the businesses and people who, in turn, will deposit the money in the bank.

If we continue this for a while, we can see that the initial deposit of $100M added $1000M to the economy. The total money flowing through the economy is $1000M now. In other words, if we sum all the money people have in BankA, BankB, BankC and other banks, that would total $1000M. This is what economists call increasing the “money supply.”

This is a potent tool for the government. They can inject X amount into the banking system, increasing the money floating through the economy(money supply) by 10X. If they put too much money in the money supply, then too much money is chasing too few goods and services, and that would lead to inflation.

The money supply is how the government controls the interest rate. An increase in the money supply would lead to a lower interest rate, and a decrease in the money supply would lead to an increase in the interest rate.

In economic terms, the base money is called M0. In this case, the $100M would be M0. The total money in people’s wallets and their bank accounts is called M1. M2 is a measure of the US money that includes M1 plus savings deposits and money market mutual funds.

M1 = currency + deposits + traveler’s checks + other checkable deposits

M2 = M1 + savings account. + Money market mutual funds

The government tracks M1 and M2 very closely to monitor the economy's health. This graph shows how much M1 and M2 money we have in our economy.

Looking at the graph, it’s very clear that the amount of money circulating in the economy had an exponential jump in 2020. This is because the Fed pumped a lot of money into the economy during the pandemic.

ACT 4 - Controlling Interest Rate

Large banks deal with companies like Apple, Amazon, Microsoft etc. Large banks also deal with pension funds and money market managers. The need for the banking services of these big corporations changes very fast. One day they might buy a company for billions and dollars; the next, they need to borrow billions. We’ll call these large banks “commercial banks.” The banks that deal with people and small businesses are called “retail banks.”

Commercial banks need to comply with the rules and regulations of the government. One of the requirements is to have a certain “reserve ratio.” If Microsoft is buying Activision for 68.7 billion dollars, then Microsoft needs to park that money with a bank. Now that the bank has a lot of money just sitting until Microsoft needs that money. This commercial bank with excess money would like to make some money on the extra money that it has for the short term. The catch is that Microsoft any day can ask for its money. So, the commercial bank can’t plan anything long-term with this money.

There are many commercial banks in the economy. Let’s say that Amazon is dealing with another commercial bank and Amazon wants to buy back shares. Suddenly, this commercial bank has to give billions of dollars to Amazon. Now, this commercial bank needs money to meet the reserve requirement. So, this commercial bank needs money, and the other commercial bank has excess money. They can do a transaction.

Commercial banks do that daily. It’s called “overnight bank funding.” The rate a commercial bank charges another bank for overnight lending is called the “overnight bank funding rate.” Billions and billions of dollars are moved around daily between various commercial banks.

This “overnight rate” is the one that we call the “federal fund rate” or “fed interest rate” in the USA. In Canada, it’s called “policy interest rate.”

How does the Fed control the fund rate or the “overnight rate”?

We know that the government needs money to pay for its expenses. The government generates money by issuing government bonds. These bonds are issued by the government and are backed by the government. So, these bonds are pretty safe. Most likely, the bonds will not lose their value unless the government goes bankrupt. Specific types of bonds can be bought by companies, people and various institutions. For example, the Chinese government has bought many US bonds.

When the Fed wants to decrease the interest rate, then the Fed prints money. The Fed is the only institution in the USA that can print money whenever they want. Now, the Fed has lots of money. They will start buying bonds from other bondholders at the market rate with this money. So now the folks who were holding bonds are having cash in their hand. This is because they sold their bonds to the government.

Now, the bondholders have money in their hands. What do they do with the money? They put their money in the bank. So, the net effect of the Fed buying bonds is that now all the banks have more deposits.

If the banks have more money, what does it do to the “overnight lending rate”? Well, now more banks have extra money, and fewer banks need to borrow money. So, the “overnight rate” the banks can charge will fall. And this is what the Fed wanted. This is why the Fed went on a buying spree. And this is how the Fed controls the “interest rate.”

The Fed will start selling the bonds if they want to increase the interest rate. Now, the bondholders will withdraw money from their bank account, and instead of having a deposit in the bank account, they are holding a piece of paper. In the process, banks have been depleted with billions of dollars, and now they have less money. This will increase the “overnight lending rate.”

ACT 5 - Government Bonds

Let's say the government wants to build a new 100-mile road to connect two cities. The project will cost $20M and take five years to finish. After that, the government will slowly earn that money using tolls.

Now, the government needs to have the necessary money to spend it. The government can borrow money from other countries, the World Bank, the IMF etc. One other option is to issue bonds. If 10,000 people give $2k each, then that's $20M. So, the government decided to issue 10,000 bonds with an initial value of $2k. The initial value is called “face value” in the bond world.

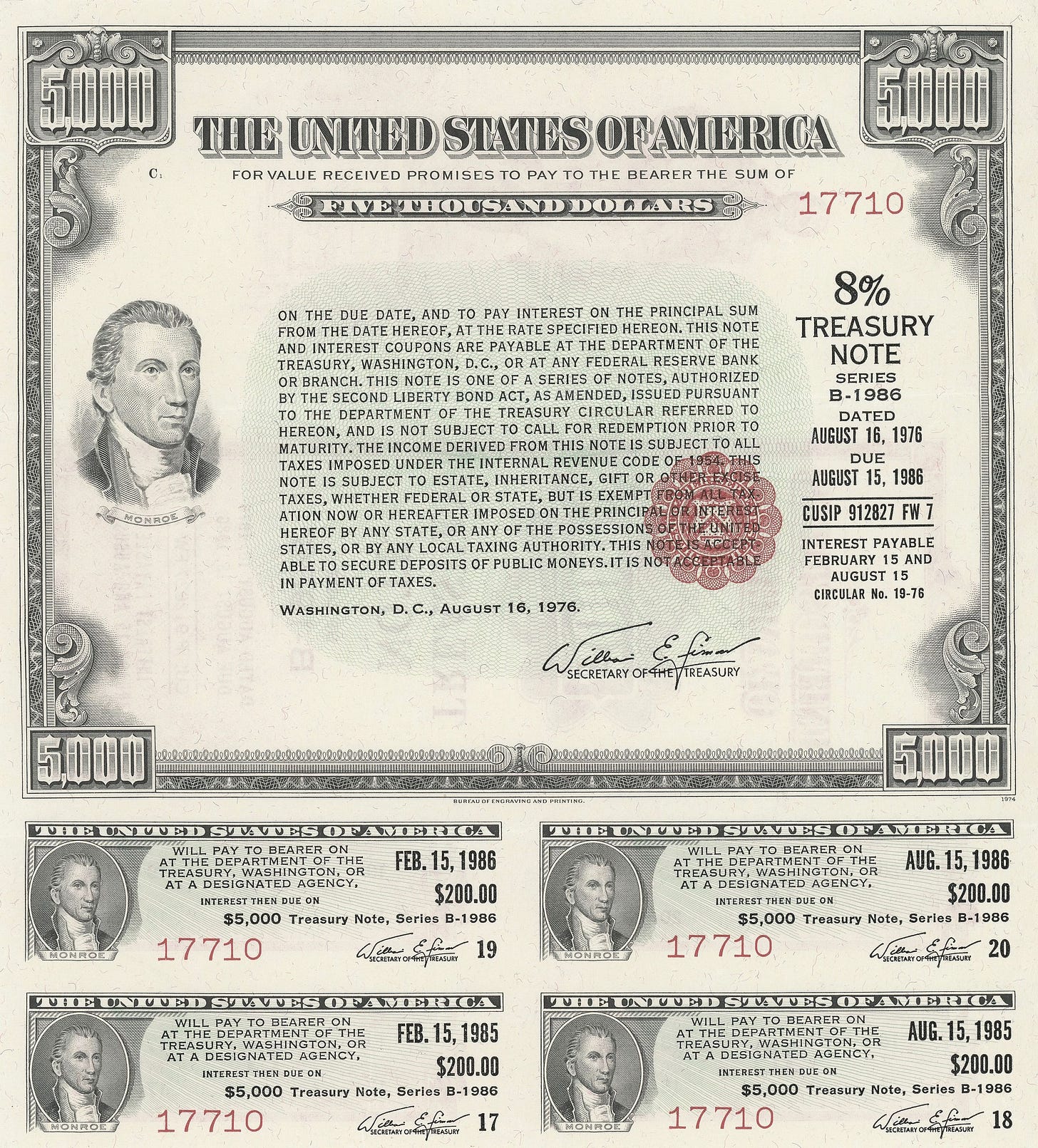

These bonds will give 10% interest. In the bond world, the word interest is not used. They call it a 10% annual coupon. It's called a coupon because in the old times, when the bonds were issued, the coupons were physically attached to the certificate, and folks would tear the coupon and take it to the government and get their money.

As we can see in the picture, we have a certificate of the bond and four coupons are attached to the certificate.

Let's say that for these bonds, maturity is in 2 years. At the end of the maturity, the entire principal amount will be repaid.

The coupons are typically paid semi-annually. In this case, the bonds are a 10% annual coupon. It means the total interest for the year will be $200 annually. So, semi-annually, it’ll be $100.

The payout scheme would look something like this.

6 months from now - the bondholder will get $100 for the first coupon

12 months from now- the bondholder will get $100 for the second coupon

18 months from now - the bondholder will get $100 for the third coupon

24 months from now - the bondholder will get $100 for the fourth coupon

At the end of 24 months, the bondholder will also get the initial $ 2,000 back when the bondholder deposits the original certificate.

The general public can buy these bonds. Corporations can buy these bonds. The pension fund manager at Wall Street can buy these bonds. Anyone who is buying this bond is lending money to the government in return for getting the coupons.

One of the essential characteristics of a bond is that it's tradable. Let's say that I bought two bonds for $4000. Two months later, I had a medical emergency, and now I need money. I can sell my bonds in the market just like I can sell stocks. The bond's selling price depends on the market conditions and how many coupons are left.

Now let's see how the bonds are related to interest rates.

As per the above graph, the interest rate in the market was 0% in Jan 2022. Now let’s assume that the government issued bonds at a 3% annual coupon and many folks bought it. Let's say that these bonds will mature in 10 years.

In July 2023, the interest rate jumped up to 5%.

Let's assume that one of the bondholders wants to sell the bond because the person needs money. Remember that these bonds pay a 3% annual coupon. The current market is paying a 5% interest rate. In this environment, if a bondholder is selling a 3% annual coupon, do you think this bondholder will get a buyer for the bonds? Buying these bonds without some discount would be stupid. So, the bondholder has to sell these bonds at a loss.

The reverse can also happen. The bonds that are currently being issued must be paying more. If the interest rate goes down tomorrow and I try to sell my bonds, then the bondholder can make some profit.

In that sense, bonds are like stocks. However, there are some significant differences. The US government has never in history defaulted on its bonds. That's why US government bonds are considered super safe. Some even call it risk-free.

Let's say that you are a billionaire in Venezuela, and some time back, Venezuela was experiencing a very tumultuous political and business environment. In such a case, it's a good idea for the rich people in Venezuela to buy US government bonds. In this way, they are not tying up their money in the local currency. The Venezuelan government might not like it, and some governments do control how much foreign investment is allowed and what's not allowed.

The bond market is estimated to be at $119 trillion. This is way bigger than the stock market, which is estimated to be at $94 trillion.

Sometimes government issues zero-coupon bonds. Now, you might wonder why anyone would ever buy a zero-coupon bond since it does not pay you anything. In 2008, the financial systems collapsed. Banks were collapsing. The stock was falling. Where would you put your money if you were a billionaire and multi-millionaire? Remember that in the USA, only the first 250K is insured. If a bank collapses and you have put in $40M in that bank, then the only money that you are guaranteed to get is 250K.

In such a situation where the economic environment is not good, buying US government bonds is a good idea because the USA has never defaulted on its bonds. However, you are not the only person thinking like this. Everyone is thinking the same thing. So, the demand for US government bonds will shoot up, which means coupon value will drop. In this case, you are not looking to get a return on your money. You seek a safe place to park your money until the economic situation stabilizes.

ACT 6 - Fiscal policy and Monetary policy

So far, I have referred to the government as the entity that sets the interest rate and injects money into the banks. Technically, that’s not true. It’s the “Federal Reserve” that does all that. Although the word “Federal” is in its name, it’s not part of the government technically. It’s an independent entity but works closely with the government on various policy matters.

In the press, you will hear that the “Fed has increased the interest rate.” Here, by “Fed,” they mean the “Federal Reserve.”

Federal Reserve is the sole entity with the power to print more money. Technically Fed doesn’t print the money. The actual printing of the money is done by the Department of Treasury, which belongs to the government. However, when to print the money and how much to print the money is solely decided by the Fed.

The government can shape economic policy through its various programs. For example, a government can provide tax rebates for green energy or increase taxes on alcohol and tobacco. These policies, enacted by the executive and legislative branches of the government, are called “fiscal policy.”

The policy that manages interest rates and the money supply in the economy is called “monetary policy.”

Note that “monetary policy” is a broad tool. It can’t act with precision. Using monetary policy, we can’t incentivize people to use green energy. However, by enacting tax rebates on using electric vehicles, the government can do that, which would be under “fiscal policy.”

During the pandemic time, it’s not that only the monetary policy by the fed was in action. Fiscal policies like stimulus checks, child tax credits, enhanced unemployment, paycheck protection program (PPP), and COVID relief funds were enacted. Besides this, state and local government provided their support. The US federal government spent around $5 trillion in fiscal stimulus.

ACT 7 - Inflation and Deflation

When we have inflation, then that means prices are rising. It means any money you have in your pocket is becoming less valuable every day that passes by. That’s because the $10 you have in your pocket will fetch fewer and fewer apples in an inflationary environment as the days go by.

When we put that money in a bank, we get some interest on our deposit. This is called the “nominal interest rate.” In an inflationary environment, people prefer to put money in the bank since the money in their pocket doesn’t earn anything. It means that people are holding on to less cash and have to spend more time managing money - putting money in the bank, standing in line, filling out paperwork and then taking the money out. This extra labor of dealing with banks is not being utilized to improve the economy. It’s a wasted effort. In the current era, when more and more people are dealing with digital money, it is less of an issue.

Economists call this the “Shoe-Leather cost of inflation.” In earlier times, people had to make multiple trips to the bank and their shoes used to wear out very often because of the repeated trips to the bank. Hence the name.

There are other costs associated with inflation. All businesses need to change the price on their menu card very often. From the accounting point of it’s more time-consuming to see which company did better or worse because all the numbers need to be adjusted for inflation.

If the interest rate offered by a bank is 5% and if the inflation is 3%, then at the end of the year, the purchasing power of the money has increased by only 2%. In this example, 5% is the “nominal interest rate,” but 2% is the “real interest rate.” If, for any reason, the inflation is higher than the nominal interest rate, then the money sitting in the bank is losing value as each day passes by. This creates a lot of uncertainty in the market and makes it difficult to do business.

If the economy is experiencing inflation and the folks believe that the government will not do much to bring it down, it would become a self-perpetuating cycle, and inflation would quickly go out of hand. If you work at a factory, you see that inflation is 10%. You don’t believe that inflation is going to go down anytime soon. So you will walk up to your boss, and you will ask your boss for a 10% raise to keep up with the inflation. Your boss instantly grants you a 10% raise.

The company will turn around and increase the price of goods and services it sells by 10% to offset the cost of labor. Next year, the same cycle will continue, and the economy will experience a persistent 10% inflation.

To break this cycle, people need to believe that the government is taking active actions to tame inflation. If this belief is there, you will wait for a while before you go and ask for a raise from your boss. And your boss will ask you to wait for a while before you get a raise. And the boss is less likely to increase the price of the goods and services to its consumers.

Deflation is the opposite of inflation. When the prices are falling, then it’s deflation. From the consumer's point of view, we should be thrilled that prices are falling. However, from the economist’s point of view, deflation is an extremely dangerous situation.

If the price falls, those items will be cheaper next week/month. In that case, why would any consumer buy anything today? Everyone will stop purchasing non-essential items. That would create havoc in the economy. This will reduce the demand a lot. When demand is reduced, then what happens? Prices drop. When consumers are not coming to the store to buy anything, the shopkeepers will have no choice but to reduce the price, making deflation worse. Breaking a deflationary cycle is extremely hard.

That’s why the government’s policies would rather err on the side of inflation than deflation.

It seems China is facing deflation, which can impact the broader global economy.

ACT 8 - Observations & Conclusion

The Fed cut rates from 6.5% to 1.75% from 2000-2002(dot com crash), while the S&P 500 declined by over 50%. The Fed cut rates from 5.25% to 0% from 2007 - 2009(financial meltdown), while the S&P 500 declined by over 50%. During the pandemic, the market fell 35% in a month. Given that the market had not even fallen 50%, not many expected that the Fed would cut the interest rate to zero percent.

2022 was the biggest year of wealth destruction for the US equity market. In 2008, Russel 3000 saw a fall of $6.7 trillion. In 2022, Russel 3000 saw a decline of $11.2 trillion.

Earlier, we discussed that the Fed buys government bonds when the Fed wants to decrease the interest rate. Between 2008 and 2021, the Fed bought eight trillion dollars of bonds, bringing the interest rate to zero.

During the pandemic, government bonds yielded interest between 0 - 0.5%.

Wells Fargo economists estimate the accumulated excess savings for US households stood at $2.3 trillion. The continued household expenditure keeps the US from recession despite the increased interest rate.

The S&P 500 averages 8-10% annual returns for the last few years: +29% in 2019, +16% in 2020, +27% in 2021, -19% in 2022, and so far in 2023, +17%. These high returns are not sustainable for the long term. A correction is in the order.

The government printed $13 trillion to fight COVID: $5.2 trillion for COVID, $4.5 trillion for quantitative easing and $3 trillion for infrastructure.

Conclusion

As per the book The Price of Time: The Real Story of Interest, people started charging interest for money even before we discovered the wheel. That’s understandable because the interest charged is the price of not using the money by oneself. When the interest rate is high, it ensures that the intention of the borrower is to put that money to productive use. When the interest rate is low (money is cheap), one can play with the money and try things out. It means the need for the borrowed money to be productive is a lot less.

Before the advent of modern banking, lending was a very risky business. It was hard to determine credit worthiness of a person. To compensate for this risk, the lenders used to charge high-interest rates. This became an issue with many governments and kings, and usury was outlawed in many parts of the world. Many religions outlawed usury.

Thanks to modern banking, now the central bank controls the interest rate, and they can make money cheap anytime they want. If and when money becomes cheap, then the general public definitely benefits in the short term because the low interest rate creates more jobs. However, we know that if the money is not put to good use, then productivity declines, and the economy suffers. If the economy suffers, then most of the suffering falls on the ordinary people. In the short term ordinary people might get a 20% raise on their salary, but the cheap money allows the rich people to make much more than 20% on their money.

If you are rich, then by definition, you have the means to both take the cheap money and deploy this cheap money to make money.

The Fed kept the interest rate low for the longest time in recorded history. It resulted in now the Fed being forced to adopt the steepest increase in the interest rate to combat inflation and the increase in the interest rate is causing collateral damage. The collapse of Silicon Valley bank is one example of this collateral damage.

The Fed is trying hard to contain inflation without causing a recession. Only time will tell if the Fed is able to succeed in this or not. The relationship between the high-interest rate and a recession is solid.

In this graph, the shaded area indicates the US recession. As we can see almost every single time the interest rate was raised, a recession happened. However, there is a lag. Sometimes, the economy went into recession six months after the interest rate peak, and sometimes, the economy took two years to get into a recession.

A few weeks ago, the Fed increased the interest rate to the highest level in 20 years. Even if the Fed doesn’t increase the interest rate further and holds the interest rate for another 12 to 24 months, it will send a shockwave throughout the world. Not because the interest rate is too high. It’s because the world and businesses got addicted to cheap money for too long.

If you read The Wall Street Journal, you will notice that the bankers are already clamoring for the interest rate to be reduced. Because of the high-interest rate, money is no longer cheap. It means mergers and acquisitions are down. IPOs are down. Bankers are making a lot less money compared to the pandemic time.

How long the Fed is able to keep the interest rate high is anyone’s guess, but it seems clear to me that they would not be able to reduce the interest rate anytime in 2023 or 2024. It means the world needs to brace for a more challenging time ahead.

Thanks for reading. If you have any feedback, then please post a comment. We are the folks from neeto where we are building a number of software products.

This blog is a great example of how to write effectively about complex topics. It's informative, engaging, and well-structured. Thank you for sharing knowledge with the world!